Multifamily Cap Rates 2025

Multifamily Cap Rates 2025. As 2025 approaches, the multifamily market is on track for a significant recovery, driven by stabilizing interest rates and robust demand. With reduced multifamily sales volume in 2023, investors were searching for data to understand how market cap rates have moved.

So the world’s biggest two economies. However, success won’t be guaranteed for everyone.

Multifamily Cap Rates 2025 Images References :

Source: vikingcapllc.com

Source: vikingcapllc.com

Multifamily Cap Rates Explained A Comprehensive Breakdown for, The average multifamily vacancy rate is expected to end 2025 at 4.9% and average annual rent growth at 2.6%.

Source: cpicapital.ca

Source: cpicapital.ca

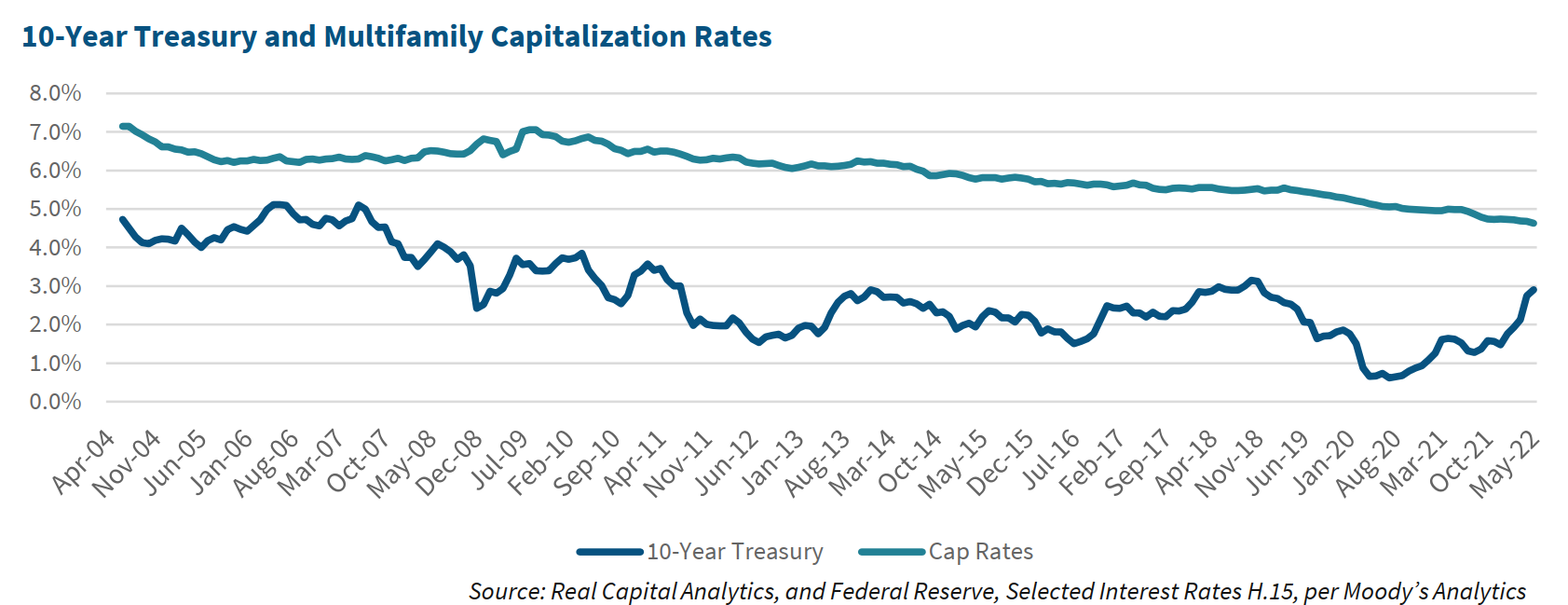

How Rising Interest Rates will affect Multifamily Cap Rates CPI, Roughly 40% of firms with at least some exposure to multifamily in their portfolios expect net operating income (noi) growth to decrease over the next 12 months;

Source: multifamily.fanniemae.com

Source: multifamily.fanniemae.com

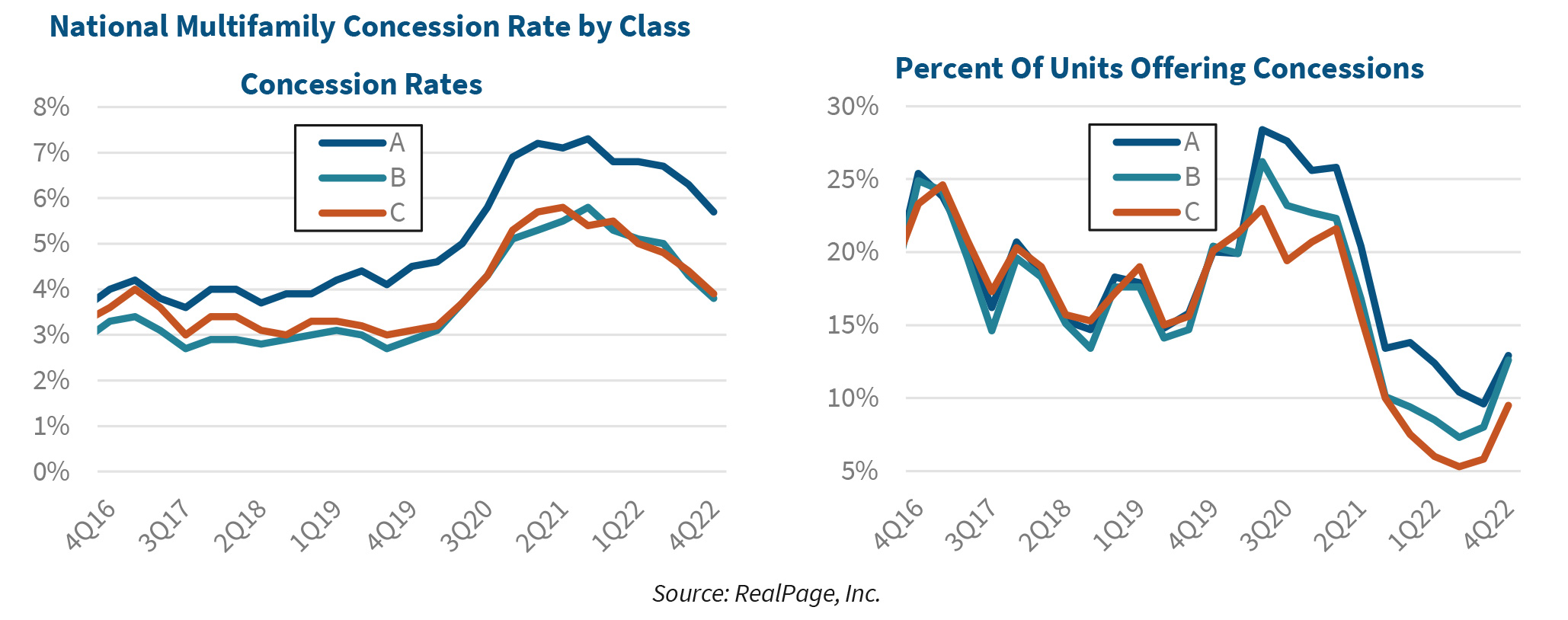

2022 MidYear Multifamily Market Outlook Demand Remains Resilient, This marks the third consecutive quarter.

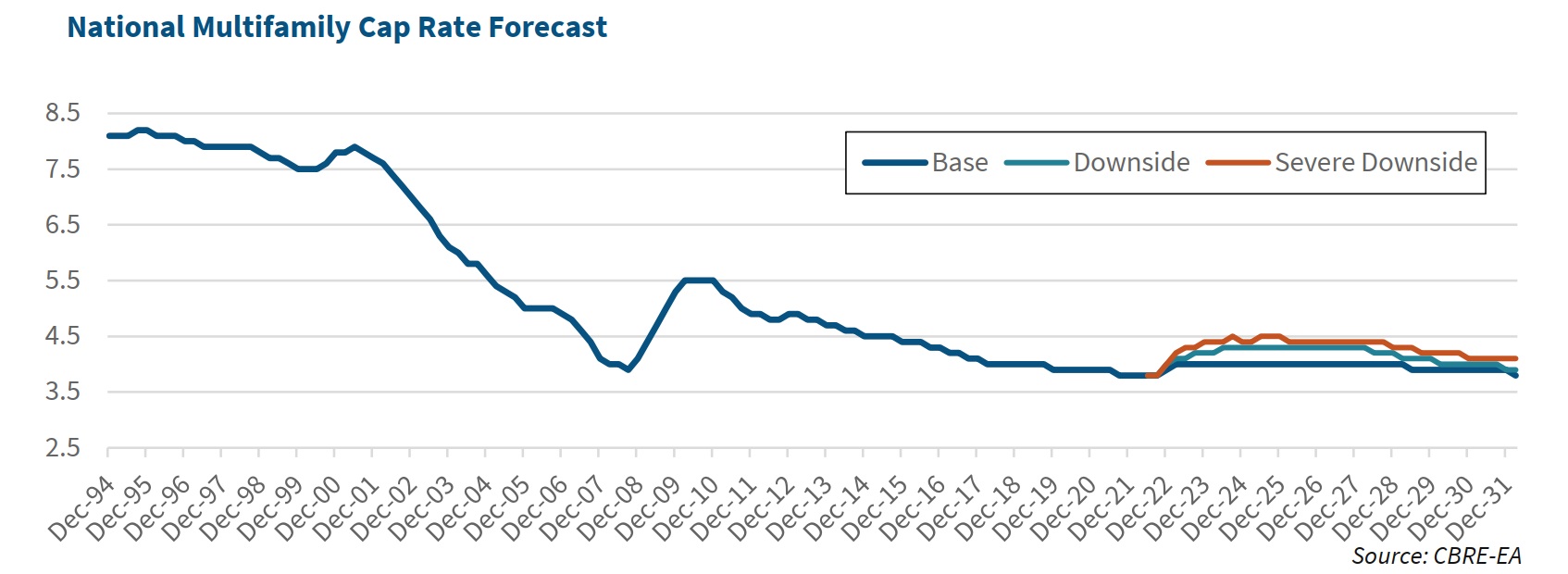

Source: www.cbre.com

Source: www.cbre.com

Cap Rates for Prime Multifamily Assets Stabilize in Q2 CBRE, That is roughly in line with the 25.

Source: cesyamaddalena.pages.dev

Source: cesyamaddalena.pages.dev

Hotel Cap Rates 2025 Alma Lyndel, San diego stands out as one of the top cities for apartment building investments in 2025.

Source: multifamily.fanniemae.com

Source: multifamily.fanniemae.com

2022 MidYear Multifamily Market Outlook Demand Remains Resilient, Where the average monthly cost of buying a house is forecast to be two to.

Source: www.cbre.com

Source: www.cbre.com

Cap Rates for Prime Multifamily Assets Stabilize in Q2 CBRE, Limited supply, high rental demand, and a thriving local economy make it.

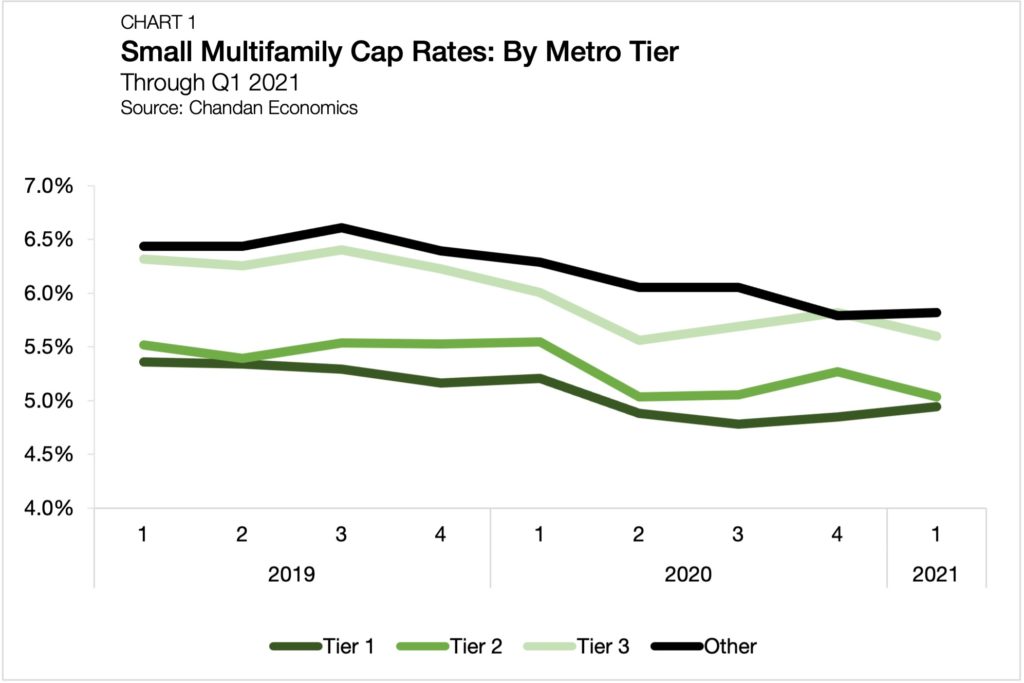

Source: arbor.com

Source: arbor.com

Q1 2021 Small Multifamily Metro Area Cap Rate Trends Arbor Realty, In total, nearly $40 billion of.

Source: multifamily.fanniemae.com

Source: multifamily.fanniemae.com

2023 Multifamily Market Outlook Turbulence Ahead Fannie Mae Multifamily, The average multifamily vacancy rate is expected to end 2025 at 4.9% and average annual rent growth at 2.6%.

Capitalization Rates in the Multifamily Sector A Deep Dive, Indeed, as of may 2022, office and retail cap rates remained well over 100 basis points higher than.

Category: 2025