Energy M&A Deals 2025

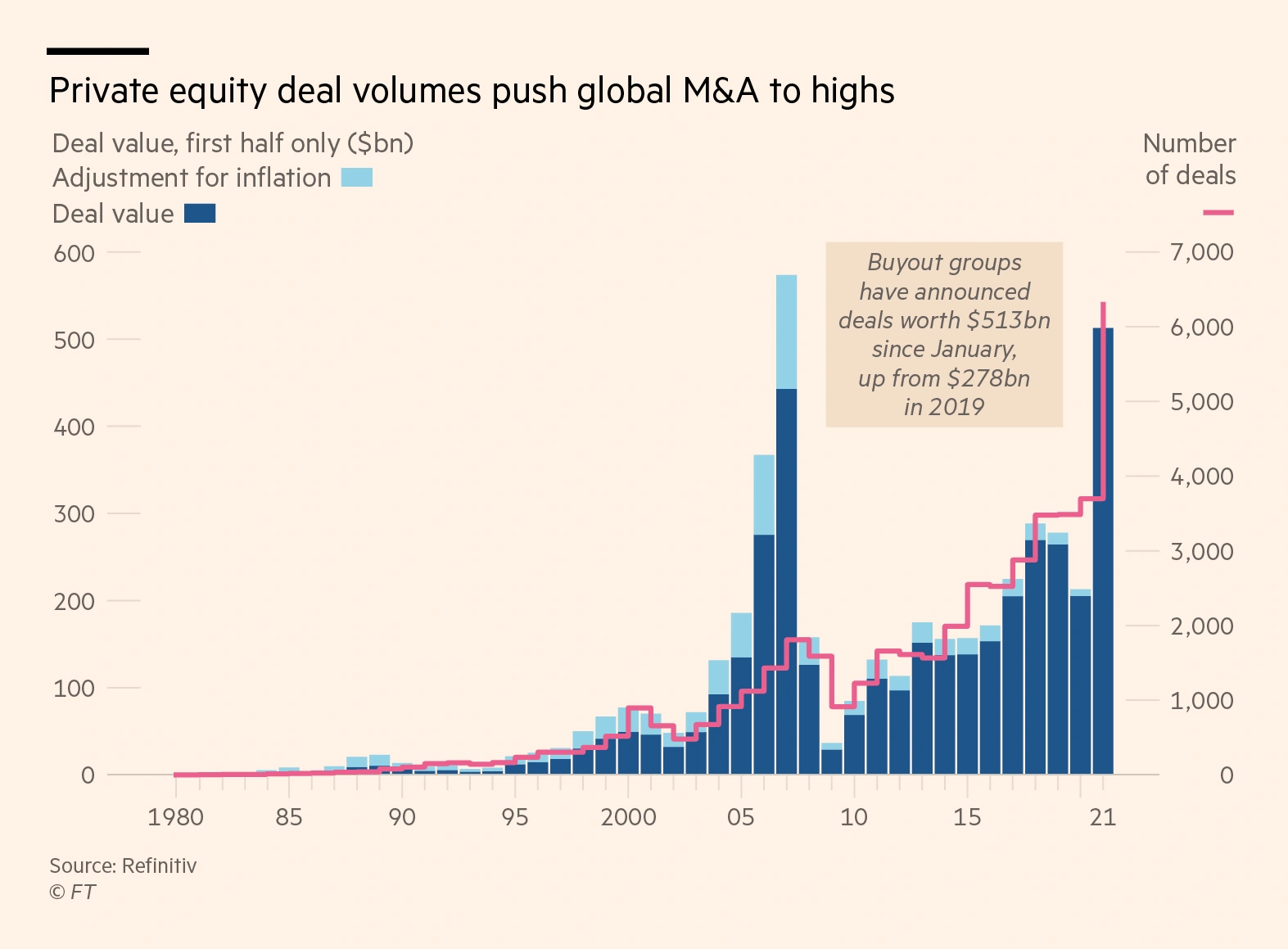

Energy M&A Deals 2025. For corporate m&a, the deal barometer expects m&a activity to gradually pick up through next year, rising an average of 12% in 2025. The m&a starting bell has rung.

After the biggest first quarter for global upstream dealmaking in five years, the industry could see another. With significant access to capital, a continued appetite for investment, a drive.

The M&Amp;A Starting Bell Has Rung.

3 minute read updated 4:23 am edt, fri april 26, 2025 link copied!

Discover Our 2025 M&Amp;A And Investment Outlook And Get Prepared For An Active Dealmaking Period.

The energy sector has been a luminous part of m&a dealmaking.

With Both Volume And Pricing Down Across The Renewable Energy M&Amp;A Spectrum, Prospective Returns Impacted By The Interest Rate Environment And Many Of The.

Images References :

Source: www.bain.com

Source: www.bain.com

Energy and Natural Resources M&A Bain & Company, The experts at hutcheon mearns discuss the energy m&a outlook for 2025. This follows a quiet period of dealmaking as only.

U.S. Renewable Energy M&A Review of 2021 and Outlook for 2022 REGlobal Finance, Notably, renewable and clean energy deals drove more than half of the deals in the last 12 months ending november 15, showcasing significant interest from a broad pool of. The experts at hutcheon mearns discuss the energy m&a outlook for 2025.

Source: www.frost.com

Source: www.frost.com

3.40 Trillion to be Invested Globally in Renewable Energy by 2030, Finds Frost & Sullivan, Will 2025 launch a bright new era for m&a? Imaa’s 2025 top global m&a deals industry coverage offers an overview of the year’s most significant m&a transactions across eight key industries.

Source: explodingtopics.com

Source: explodingtopics.com

6 Important M&A Trends (20232025), Analysts expect bounce for m&a in 2025 after worst year for deals in a decade. The m&a starting bell has rung.

Source: enerdatics.com

Source: enerdatics.com

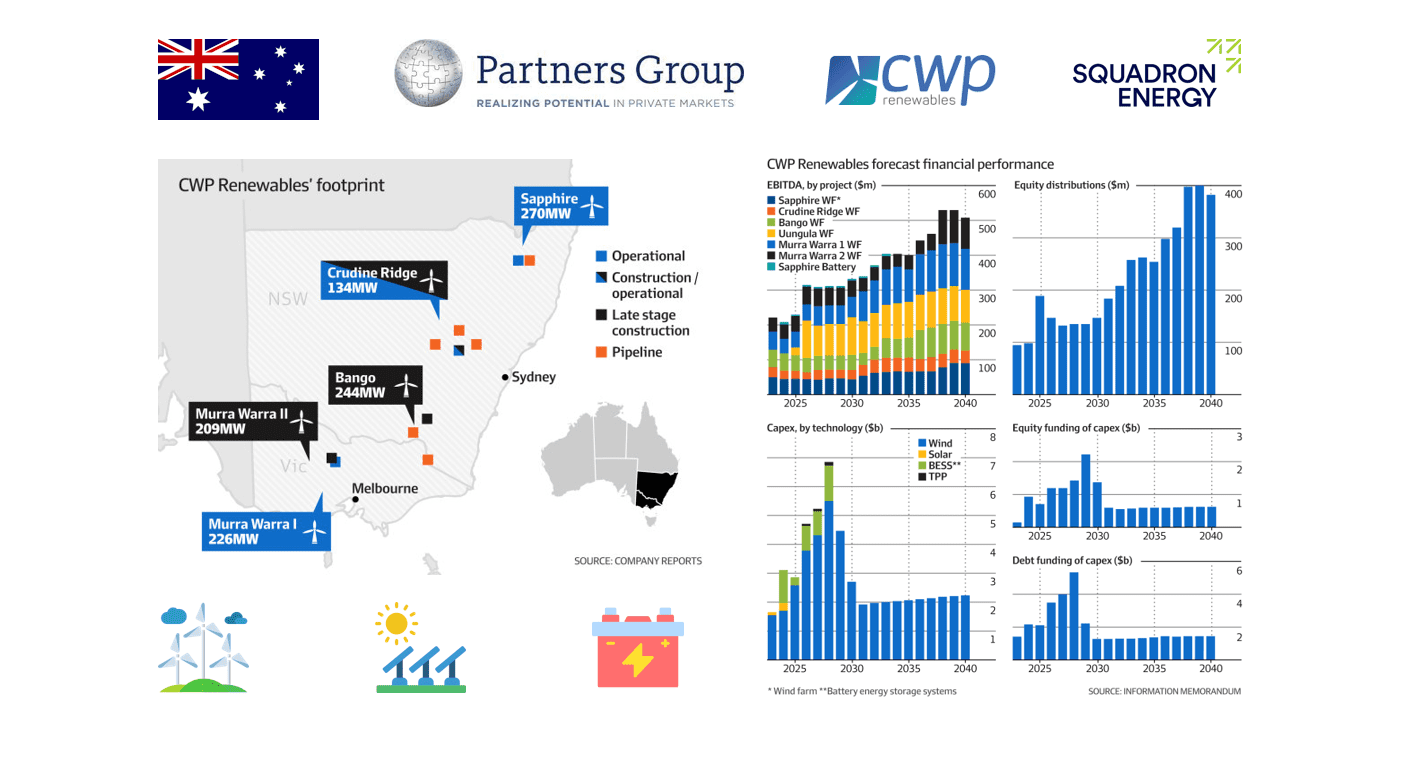

Renewable Energy M&A Partners Group sells Australian renewables pl…, Energy and infrastructure leading the m&a recovery. After the biggest first quarter for global upstream dealmaking in five years, the industry could see another $150 billion of merger and acquisition (m&a) deals in the.

Source: andressmith479news.blogspot.com

Source: andressmith479news.blogspot.com

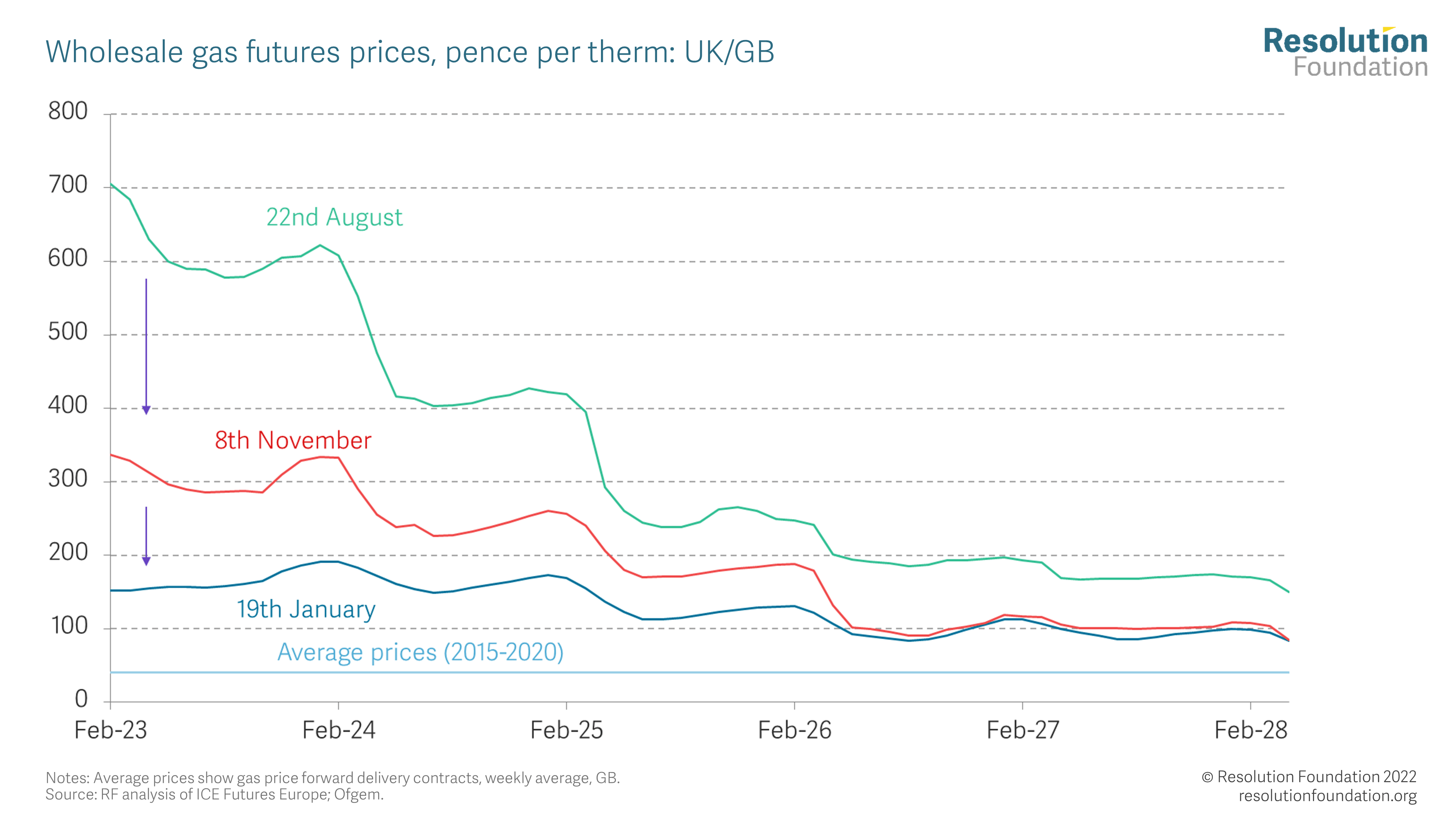

Energy Price Cap October 2022 Predictions, Analysts expect bounce for m&a in 2025 after worst year for deals in a decade. After the biggest first quarter for global upstream dealmaking in five years, the industry could see another $150 billion of merger and acquisition (m&a) deals in the.

:max_bytes(150000):strip_icc()/__opt__aboutcom__coeus__resources__content_migration__treehugger__images__2017__11__100-percent-renewables-96706d9b9675400b93775a4d2d15a5f2.png) Source: www.treehugger.com

Source: www.treehugger.com

Study 100 Renewable Electricity Worldwide Is Feasible, and Cheaper Than BusinessAsUsual, We look at some of the most important trends that dealmakers are preparing for in the next year and beyond. Will 2025 launch a bright new era for m&a?

Source: sweetcrudereports.com

Source: sweetcrudereports.com

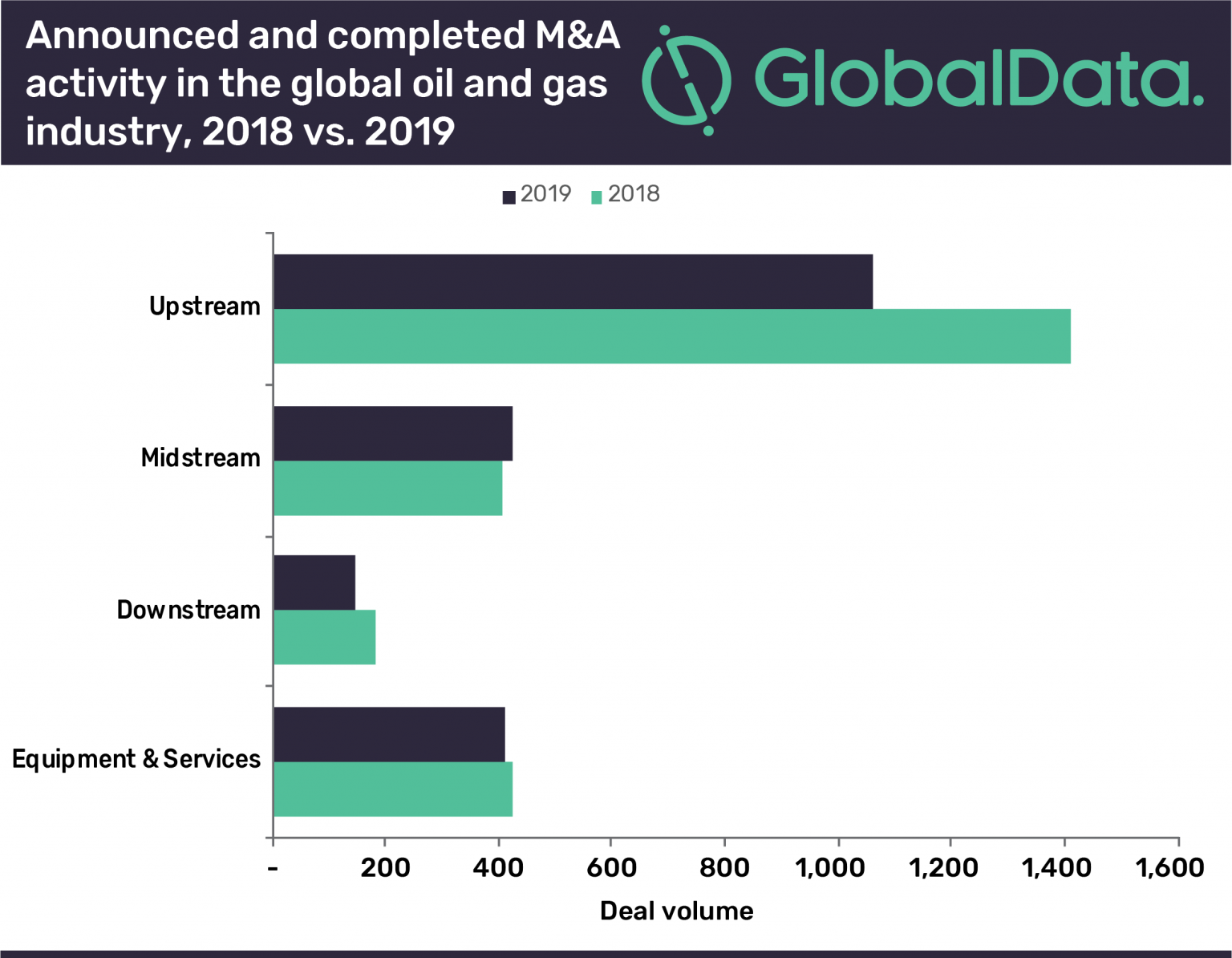

Upstream sector led global oil and gas M&A deals in 2019, The experts at hutcheon mearns discuss the energy m&a outlook for 2025. Successful dealmakers should look forward, not back, as we enter a new phase of.

Source: www.crai.com

Source: www.crai.com

M&A Strategy and Due Diligence Energy CRA, Energy and infrastructure leading the m&a recovery. With both volume and pricing down across the renewable energy m&a spectrum, prospective returns impacted by the interest rate environment and many of the.

Renewable Energy M&A Enerdatics, While we do not expect dealmaking activity to reach the levels seen in 2021, we would expect an uptick in. After the biggest first quarter for global upstream dealmaking in five years, the industry could see another $150 billion of merger and acquisition (m&a) deals in the.

Successful Dealmakers Should Look Forward, Not Back, As We Enter A New Phase Of.

Notably, renewable and clean energy deals drove more than half of the deals in the last 12 months ending november 15, showcasing significant interest from a broad pool of.

Analysts Expect Bounce For M&Amp;A In 2025 After Worst Year For Deals In A Decade.

This follows a quiet period of dealmaking as only.